Author: Simon Taylor

Compiled by: Block Unicorn

Banks create money; stablecoins move it. We need both.

Proponents of tokenized deposits say: "Stablecoins are unregulated shadow banking. Once banks tokenize deposits, everyone will prefer to use banks."

Some banks and central banks love this narrative.

Proponents of stablecoins say: "Banks are dinosaurs. We don't need them on-chain. Stablecoins are the future of money."

Crypto natives particularly favor this story.

Both sides are missing the point.

Banks Provide Cheaper Credit to Their Largest Clients

You deposit $100, it becomes $90 in loans (or even more). This is how fractional reserve banking works. For centuries, it has been an engine of economic growth.

-

A Fortune 500 company deposits $500 million at JPMorgan Chase.

-

In return, they receive a massive line of credit at below-market interest rates.

-

Deposits are the bank's business model, and large corporations know this.

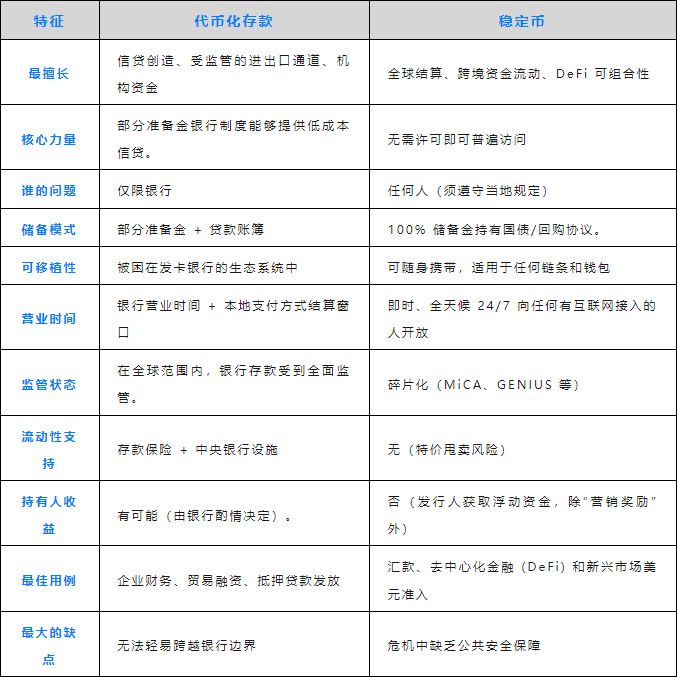

Tokenized deposits bring this mechanism on-chain, but they only serve the bank's own customers. You are still within the bank's regulatory perimeter, still subject to its business hours, processes, and compliance requirements.

For businesses that need low-cost credit lines, tokenized deposits are a good option.

Stablecoins Are Like Cash

Circle and Tether hold 100% reserves, equivalent to $200 billion in bonds. They earn a 4-5% yield but don't pay you anything.

In return, you get funds free from any bank's regulatory oversight. An estimated $9 trillion will be moved cross-border via stablecoins by 2025. Accessible anytime, anywhere with an internet connection, permissionless, 24/7.

No correspondent bank inquiries, no waiting for SWIFT settlement, no "we'll get back to you in 3-5 business days."

For a company that needs to pay an Argentine supplier at 11 PM on a Saturday, stablecoins are a good option.

The Future is Both

A company that wants a good credit line from a bank might also want to use stablecoins as an on-ramp to long-tail markets.

Imagine this scenario:

-

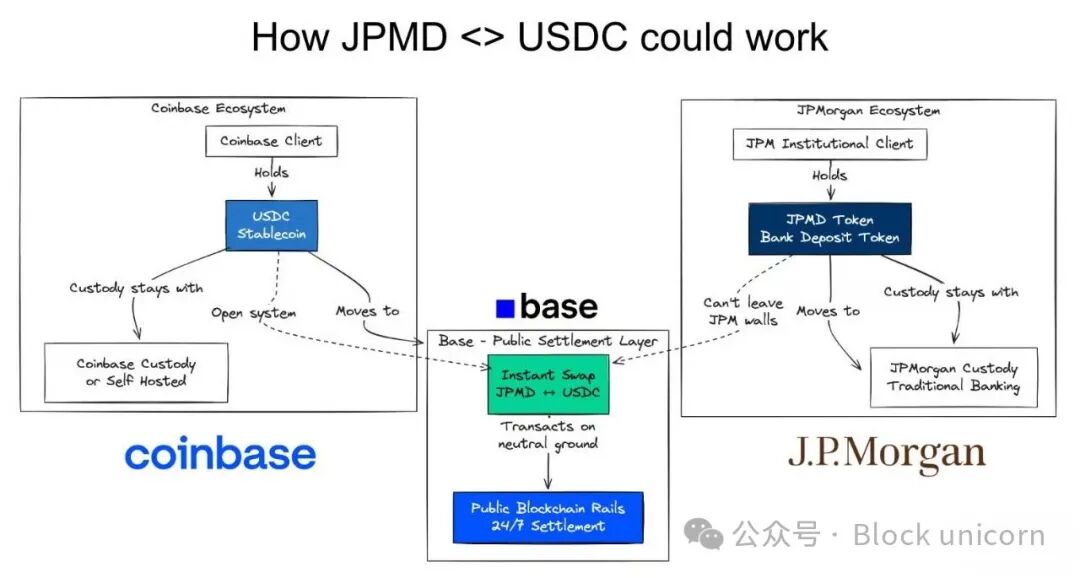

A Fortune 500 company holds tokenized deposits at JPMorgan Chase

-

In return, it gets a preferential credit line for its US operations

-

It needs to pay an Argentine supplier who prefers stablecoins.

-

So, it swaps JPMD for USDC.

This is an example of where we are headed.

On-chain. Atomic.

Having both.

Using traditional rails where they work.

Using stablecoins where they don't.

It's not an either/or. It's both.

-

Tokenized deposits → Low-cost credit inside the banking system

-

Stablecoins → Cash-like settlement outside the banking system

-

On-chain swaps → Instant conversion, zero settlement risk

Both have pros and cons.

They will coexist.

On-Chain Payments > APIs for Payment Orchestration

Some large banks might say "We don't need tokenized deposits, we have APIs," and in some cases, they are right.

This is precisely the power of on-chain finance.

Smart contracts can build logic across multiple firms and individuals. When a supplier's deposit arrives, a smart contract can automatically trigger inventory financing, working capital financing, FX hedging. Automatically. Instantly. Whether from a bank or a non-bank.

Deposit → Stablecoin → Pay invoice → Downstream payments complete.

APIs are point-to-point. Smart contracts are many-to-many. This makes them ideal for workflows that cross-organizational boundaries. This is the power of on-chain finance.

It's a fundamentally different architecture for financial services.

The Future is On-Chain

Tokenized deposits solve for low-cost credit. Deposits are locked in. Banks lend against them. Their business model remains.

Stablecoins solve for the portability of money. Funds flow permissionless, anywhere. The Global South gets access to dollars. Businesses get fast settlement.

Proponents of tokenized deposits want regulated payment rails only.

Proponents of stablecoins want to replace banks.

The future needs both.

Fortune 500s want massive credit lines from banks AND instant global settlement. Emerging markets want local credit creation AND dollar on-ramps. DeFi wants composability AND real-world asset backing.

Arguing about who wins misses what's happening. The future of finance is on-chain. Tokenized deposits and stablecoins are both necessary infrastructure to get there.

Stop arguing about who wins. Start building interoperability.

Composable money.